Share this:

“Did you know your currency is getting digitized?”

When we all were tired of the long queues in banks and ATMs and scared of travelling with cash the world came with the solution of Digital money – better to be called CRYPTOCURRENCY.

With the plunging of economies amidst the global crisis of 2008, cryptocurrency found it’s way as a solution to a lot of investors. Not being registered with any central of government bank, the first every cryptocurrency – BITCOIN had a face value of nearly US$ 20 to US$ 30 in 2009. Twelve years since then the year 2021, marks the face value of BITCOIN at US$ 29000 –a true definition of innovation.

With the plunging of economies amidst the global crisis of 2008, cryptocurrency found it’s way as a solution to a lot of investors. Not being registered with any central of government bank, the first every cryptocurrency – BITCOIN had a face value of nearly US$ 20 to US$ 30 in 2009. Twelve years since then the year 2021, marks the face value of BITCOIN at US$ 29000 –a true definition of innovation.

Crypto currencies run the whole system through decentralized ledger of peer-to-peer network transactions, where the participants can confirm transactions of transfers, trade settlement and more without any needed permission of central clearing authority. Three step process – request, validation and verification of the transaction source and receiver completes the transaction, creating a new permanent block for every transaction.

No intrinsic value, no physical form and no involvement of central bank, yet crypto currency is used as a medium of exchange by creating, storing and verifying monetary units and transfers through encryptions. Increased transparency, complete control, instant tracking, permanent record and the cherry on the cake benefit reduced transaction cost, have made cryptocurrency the superstar of the decade.

As of now, there are more than 10,000 crypto currencies floating in the market. Amidst which the bigger fight exists between coins and tokens. The revolution of differentiating bitcoins and other coins, Altcoins took birth in the name of Peercoin, Litecoin, Dogecoin, Auroracoin and Namecoin. Beyond the umbrella of trending Bitcoins, a few cryptos have created their own protocols and support systems – Ethereum, Ripple, Omni, Nxt, Waves and Counterparty. Furthermore, adding to the realm of cryptocurrencies, have evolved the doppelganger of stock market under the name of token. Tokens are created and traded through Initial Coin Offering analogous to the stock market offering, represented as value tokens, security tokens and utility tokens. Having its own value similar to determination of value of US dollar, it has its own encryption technique and are mainly used for bill payments.

Gazing over the leading cryptocurrencies Bitcoins, Ethereum, Tether, Binance coin and Cardano have been the five top rulers of the market. All of them seeking ways to prove their superiority in consumer outreach and ease of use, over each other. Bitcoin (BTC) has been the ruler with a share capital of US$861B, Ethereum (ETH) has a share capital of US$367B, Tether (USDT) possesses a share capital of US$62B, Binance coin (BNB) has a share capital of US$60B and Cardano (ADA) has a share capital of US$47B. BTC alone cuts off much more than 50% share of the total cryptocurrency market with a price of US$ 45864 per coin in circulation. Whereas the followers like ETH can hardly sell their currencies at a face value of nearly US$3162 per coin, USDT at US$1 per coin, BNB at US$ 357 per coin and ADA at US$ 1.49 per coin.

Despite the glaring difference in market value, ETH has been able to climb the stairs of success, by building a digital economy, and finding bold new ways to earn online, transfer online, receive, borrow, earn interest, and even stream funds anywhere in the world. ETH is gaining it’s popularity due to it’s decentralized finance (DeFi) system never sleeps or discriminates. Through its non-fungible tokens (NFTs) has helped tokenize the art as well as anything that can be represented, traded and put to use and items for which one can get royalties every time its re-sold.

With the tagline digital money, for digital age USDT has been focused on anchoring or tethering the value to the price of national currencies like the US dollar, the Euro, and the offshore Chinese yuan. Every Tether token is always 100% backed, with traditional currency and cash equivalents and from time to time include other assets and receivables from loans made by Tether to third parties, which may include affiliated entities (collectively, “reserves”). Every Tether token is also 1-to-1 pegged to the dollar, so 1 USD₮ Token is always valued by Tether at 1 USD. With the feature of transparency, security and integration to industry support, USDT is on the way to build it’s own brand image.

BNB has been built on blockchain of ETH, with the aim to empower the cryptocurrency platform and boost its operations to establish a sustainable ecosystem. The currency has basic functions of multitude of purposes including paying the listing fee, exchange fee, trading fee, or any other charges that a user may incur on the exchange. With speedy transactions and benefit of being exchanged for 150 different other cryptocurrencies, it has rolled to be the fourth largest digital money in use in the world.

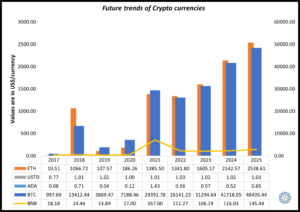

Table 1: Trends in Value of cryptocurrencies

(Value in US$ per coin)

Year | BTC | ETH | USTD | BNB | ADA |

2017 | 997.69 | 10.51 | 0.77 | 18.18 | 0.08 |

2018 | 13412.44 | 1066.72 | 1.01 | 24.46 | 0.71 |

2019 | 3869.47 | 107.57 | 1.02 | 13.89 | 0.04 |

2020 | 7188.46 | 186.26 | 1.00 | 27.00 | 0.12 |

2021 | 29391.78 | 1385.50 | 1.01 | 357.00 | 1.43 |

ADA is a digital currency, which can be used by any user without requiring any third party to mediate the exchange. Every transaction is permanently, securely, and transparently recorded on the Cardano blockchain. The currencies are stored in wallets and can be delegated to a stake pool to earn rewards. Cardano gives the benefit to be used on any platform with usable in variety of applications. Though ADA had a flat growth rate from 2018 to 2021, but after January 2021 it caught pace and moved to being the fifth largely traded cryptocurrency in the world.

Source: Unisights Research and Analytics

Fig. 1: Future trends in price of cryptocurrencies

Analysis of the price of five major cryptocurrencies from 2017 to 2025, shows that the demand has been on an increasing trend. Though the demand had been low during the previous years of launch, but after 2018-19 the demand caught pace and by the end of 2020 and beginning of 2021 the demand has seen a robust rise in many currencies. Further, the graph also exhibits that Bitcoin, Ethereum and Binance coin has greater scope of increase in the future. Increased diversity in investment, due to globalization has opened larger avenues for digitization of currency. The study forecasts that the future holds greater scope for use of cryptocurrencies by individuals and industries, in daily trading to IPOs.

Unisights research will help you to evaluate and explore more about the cryptocurrencies and it’s uses. We can help you to evaluate the pros and cons of all the trending crypto’s along with their future scope and profits.

Share this:

Thanks.