Share this:

The Consequences of decisions not backed by Insights & Data

Companies thrive on effective and efficient decisions. These decisions are the product of countless hours of brainstorming, responsibility, and accountability. The efficacy of these decisions determines the company’s position in the market, and the efficiency of the same drives them forward in the race to beat the market. It comes as no surprise, then, to analyze and improve the decision-making process at every stage of operations. Given the rising significance attributed to data-driven decision-making, companies are still trying to adapt before it’s too late. Some are yet to begin the transition from an intuitive, subjective process to an analytical objective one.

To understand why it is imperative to make this transition, here are some cases where decisions not backed by data led to consequences.

- Google was almost sold to another company, Excite, back in 1998. At a valuation of $750,000, the price seemed justified at some points, and the deal was still in the works. One half of the story was the comparison of the search results between Google and Excite and other engines. The searches were not reasonably spaced apart from a consumer point of view, thereby leading to a lack of justifiable differences between these engines. The other half was that consumer retention as an insight in this process, was understood in a different way. Excite wanted to produce the results in a round-about way instead of Google’s straightforward approach so that users will “stick” to the site for a longer time. It was not understood then that fascinating numbers in the near future would lose to stable and growing numbers in the long run. Longer usage time per visit may look appreciable, but the users who return due to faster results made a better metric. At that time, crunching the numbers was hard, and obtaining them was more complex. There were cultural differences between the two companies, and they’ve admitted how it is easy for them to look bad in hindsight. But viewing the deal with skewed opinions and questionable numbers over deploying tangible metrics and obtaining observations made Excite give way to a $700 billion+ worth company.

- Google Fiber was touted as a game-changing broadband service, owing to the core technology and mind-blowing promises. But it never picked up owing to a range of reasons. Among the chief reasons were the inability to understand the infrastructure requirements and pricing strategies. The infrastructure required for providing high-speed fiber-based internet is monumental, and as they relied on dark fiber deployments, other legacy providers continued to beat them to market. Starting with high prices at $70 per month, they stepped down to appeal to the consumers while digging further on their way to break even on revenue. Ultimately, it has been on hold for a while and is yet to be launched the way it was deemed to be.

- Being backed by then-president Barack Obama would be a dream come true for any PR team. With that amount of public attention, each decision should be trodden carefully, and every move precise. But Solyndra, a solar energy company, didn’t get it right and inevitably failed to Chinese producers. Despite getting huge investments and funding options, their inability to craft a business plan and the decisions they made on top of a non-existing business plan led them to file for bankruptcy in 2011.

- One of the pioneers in the smartphone market, Samsung made eye-catching forays into the foldable phone. Quoted as an “embarrassing failure” by the then-CEO after the failure, over $130 million were spent on launching the Galaxy Fold in 2019. More than 50% of the phones sent to high-profile reviewers simply broke, and their branding value plummeted. This disaster came after the lack of consumer and user experience testing. There were no notifications as to the importance of leaving the screen protector on, and eventually, the damage was done, literally. A similar error happened with the Galaxy Note 7 in 2016, where the phones burst into flames.

- Among other failures, JC Penney’s failure is documented with the most attribution to lack of understanding data. Ron Johnson, a new CEO in 2012, was brought in to revitalize the famous departmental store chain. Instead, he had almost run the company to the ground with astounding losses of over $50 billion and losing 50% market capitalization. Even with considerable evidence opposing his decisions through focus groups, he continues to implement them without testing and experimenting with them. His most significant decision with regard to revamping the pricing strategy was met with disregard by the buyers, and ultimately, he was fired within six months.

- Sometimes, the lack of proper representation of the available data could also lead to failure. The Enron Scandal in 2001 is one such example where corporate fraud stemmed from fraudulent numbers sent back and forth between investors and other stakeholders. The executives were involved in the highest levels of malpractice, and ultimately, the energy magnate had to be shut down after numerous investigations.

In the long list of failures with regard to decision-making, the HiPPO effect casts a dark shadow over most of them. The HiPPO (Highest paid person’s opinion) is often looked up to when there’s a lack of data, and unsurprisingly, the status quo is such that experience and subjective opinions lose out on ironing out data acquisition and experimenting strategies.

One could argue that data is not available at all stages of operations. In fact, there are various reasons why executives are not able to make data-driven decisions. Chief among them are the lack of quality in data and necessary information to quantify data. Companies thus need to implement better measures in their data governance and analyze the trade-off in implementing cost-effective data acquisition strategies that pay back in the long run.

Even where there is valid data available, tools and methodologies like the Norm Breaking Model should be used to effectively arrive at decisions backed by data. When making critical decisions that affect vital components of the business, data needs to be utilized as a tool that supports the decision-making process and is not the only basis.

In other cases, the numbers derived from subjective opinions need to be condensed to make objective insights that ultimately enhance a company’s operation.

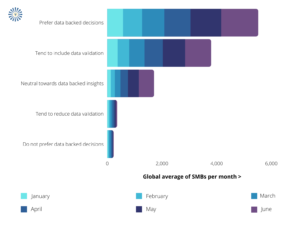

Now, to understand the changing behavioral patterns in the business world today, we conducted a research on the global SMB organizations during the first half of 2021. Here’s a glimpse:

The results have been promising in terms of the global outlook towards the data & insights. Post Covid-Era has made a lot of brands realize the power and importance of data backed decision making. And that is one reason we are in business. The insights industry is set to rise exponentially in the coming years.

Unisights Research and Analytics, after years of brainstorming and multi-industry experiences, the company is founded to bring upon a major change on how insights are driven and derived online/offline. Connect with us to know more about how we can assist you with the insight based decisions.

Share this:

Thanks for your blog, nice to read. Do not stop.

Itís difficult to find educated people for this topic, however, you seem like you know what youíre talking about! Thanks